LOAN POLICY

Introduction

Introduction:

One of the important functions of the Non-Banking Finance Company (NBFC) is to lend money to the needful to achieve economic objectives. The Reserve Bank of India is empowered to issue licenses to Non-Banking Finance Companies (NBFC) and further to issue directives/advices on loans and advances and other aspects regarding conduct of loan accounts from time to time. With liberalization in the financial system and deregulation of interest rates, NBFCs are now free to formulate loan products within the broad guidelines issued by RBI.

RBI directives can be studied in detail in various Master Circulars issued from time to time.

This policy document on loans and advances outlines the guiding principles in respect of formulation of various products offered by Pandinadu Finance Company Private Limited and terms and conditions governing the conduct of the account. It is expected that this document will impart greater transparency in dealing with the individual customers. This policy is subject to the adherence of RBI circulars in this regard and also the policy be read in concurrence with the existing RBI guidelines, directives, circulars and instructions

The ultimate objective is that the customer will get services they are rightfully entitled to receive, without demand.

The purpose of this document is to define the credit policy of the company. This is live document and supposed to be updated on a regular basis.

This document should not be seen in isolation but in conjunction with the other policy documents that define the overall working of the company.

The present economic growth of our country is sustainable. Proper credit flow is required for planning such growth. Since the existing banking structure is not in a position to meet this demand, a quicker and effective outreach is possible through the NBFC.

NBFCs are primarily carrying on its principal business of providing of finance to the public whether by making loans or advances or otherwise for any activity other than its own. NBFCs lend money in the retail segment. They borrow from banks and re-lend at a higher margin. NBFCs are not a part of the payment and settlement system and as such cannot issue Cheques drawn on itself.

NBFCs can sanction Jewel loans and other loans such as demand loan and term loans. In PFC we have designed some loans schemes which are approved by board. The details are enclosed as annex. As such PFC branches can sanction the loans which come under the scheme. For any other loan out of scheme, the same has to be approached to board for sanction.

- 2. Exposure Norms

The loan amount sanctioned to one party can’t exceed 15% of the net owned funds of the company. The Loan amount which a person can borrow is decided by his/her repayment capacity. Repayment capacity takes into consideration factors such as income, age, qualifications, number of dependents, spouse’s income, assets, liabilities, stability and continuity of occupation and savings history. Our main concern is to make sure whether the borrower can comfortably repay the loan amount.

- 3. Selection of Borrower.

The following aspects are given attention for selection of a prospective borrower.

- his/her social, family, political background and genuineness of the requirements.

- His /her source of income &repaying capacity.

- His/ her track record of taking loans from Banks, financial institutes and adherence to repayment schedule.

- his/her confidential report through our source or local market inquiry

- Age of the customer should not be more than sixty five years so as to ensure the repayment schedule to be fixed keeping in view the average age criteria of the geographical region.

Selection of a right customer is the most important aspect of any financial activity and hence all prudent safe guards are to be adopted.

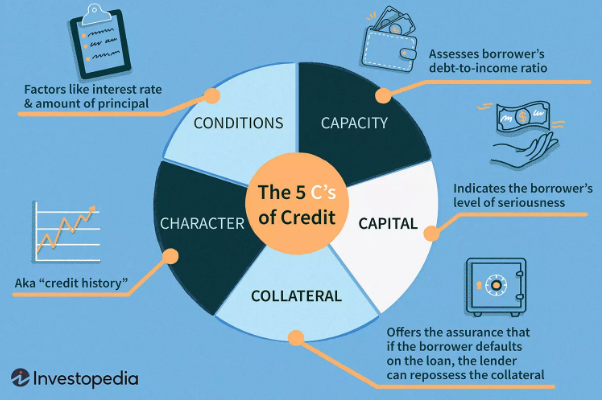

- 4. Five ‘C’s of credit

The five Cs of credit is a system used by lenders to gauge the creditworthiness of potential borrowers. The system weighs five characteristics of the borrower and conditions of the loan, attempting to estimate the chance of default and, consequently, the risk of a financial loss for the lender. The five Cs of credit are

- The first C is character—reflected by the applicant’s credit history.

- The second C is capacity—the applicant’s debt-to-income ratio.

- The third C is capital—the amount of money an applicant has.

- The fourth C is collateral—an asset that can back or act as security for the loan.

- The fifth C is conditions—the purpose of the loan, the amount involved, and prevailing interest rates.

The five-Cs-of-credit method of evaluating a borrower incorporates both qualitative and quantitative measures. Lenders may look at a borrower’s credit reports, credit scores, income statements, and other documents relevant to the borrower’s financial situation.

4.1. Character

Although it’s called character, the first C more specifically refers to credit history: a borrower’s reputation or track record for repaying debts. This information appears on the borrower’s credit reports. Credit reports contain detailed information about how much an applicant has borrowed in the past and whether they have repaid loans on time. These reports also contain information on collection accounts and bankruptcies, and they retain most information for seven to 10 years

4.2. Capacity

Capacity measures the borrower’s ability to repay a loan by comparing income against recurring debts and assessing the borrower’s debt-to-income (DTI) ratio. Lenders calculate DTI by adding together a borrower’s total monthly debt payments and dividing that by the borrower’s gross monthly income. The lower an applicant’s DTI, the better the chance of qualifying for a new loan. In addition to examining income, lenders look at the length of time an applicant has been employed at their current job and future job stability.

4.3. Capital

Lenders also consider any capital the borrower put towards a potential investment. A large contribution by the borrower decreases the chance of default. Borrowers who can place a down payment on a home, for example, typically find it easier to receive a mortgage. Down payment size can also affect the rates and terms of a borrower’s loan. Generally speaking, larger down payments result in better rates and terms.

4.4. Collateral

Collateral can help a borrower to secure loans. It gives assurance to the lender that if the borrower defaults on the loan, the lender can get something back by repossessing the collateral. Often, the collateral is the object one is borrowing the money for: Auto loans, for instance, are secured by two/three/four wheelers, and mortgages are secured by land and building properties. For this reason, collateral-backed loans are sometimes referred to as secured loans or secured debt.

They are generally considered to be less risky for lenders to issue. As a result, loans that are secured by some form of collateral are commonly offered with lower interest rates and better terms compared to other unsecured forms of financing.

4.5. Conditions

The conditions of the loan, such as its interest rate and amount of principal, influence the lender’s desire to finance the borrower. Conditions can refer to how a borrower intends to use the money. Consider a borrower who applies for a car loan or a home improvement loan. A lender may be more likely to approve those loans because of their specific purpose, rather than a signature loan, which could be used for anything. Additionally, lenders may consider conditions that are outside of the borrower’s control, such as the state of the economy, industry trends, or pending legislative changes.

- 5. Know Your Customer (KYC) and Anti-Money Laundering (AML) guidelines

PFCL has formulated its KYC and AML policy and accordingly the same is to be followed during the disbursements of the loans and advances. All documents like identity proof, address proof, etc. are to be collected for borrowers and guarantors of loans and advances in accordance with the said policy.

- 6. CIBIL

We as a lender have to obtain a credit report from any one of the Credit Information Companies (CIC). PFCL is member of all FOUR credit information companies (CIC) and further shall implement changes in the system accordingly so as to submit data to CIC on regular intervals. This would help PFCL to share the financial details of irregular customers with other financial institutions. As such, before sanctioning any loan, extracting credit report from any one of the CIC is must. Exceptions are Jewel loan and TMB pensioner’s loan.

PFCL shall not reject any customers merely because of negative credit report or credit profile received from CIC. Such cases shall be referred to higher authorities.

- 7. Interest rate structure

PFCL has formulated interest rate policy. The management understands that considering the risk profile of the customer, it has to maintain adequate margins to cover the operational and delinquency risk. Thus, it is decided to fund the loans and advances with the Rate of Interest ranging between 12% to 24% p.a. Further, at their own sole discretion, board can approve the interest rate for any loan/advance outside the range above.

The rate of interest for loans is fixed. At present floating rate criteria is not implemented.

Maximum period shall be up to five years for Term loans and for housing loans the maximum period shall be fifteen years depending upon the quantum of loan and the repayment capacity of the borrower.

- 8. Charges

PFCL shall levy various charges on the customers as per the operations of the account and certain standard charges as applicable. Further, at their sole discretion, the management of PFCL can reduce or waive all or any of the charges so applied considering the best interest of the customer.

- 9. Overriding powers

PFCL has been operating in very close vigilance and supervision of its higher management. Thus, board is having overriding powers to approve or disapprove, add or modify any of the provisions of this policy to the best interest of the Company and to override the norms of the scheme loans.

- 10. Security Evaluation

10.1. Technical Evaluation

A qualified technical person approved by the company will conduct valuation on the property intended to offer as security.

The technical person prepares a detailed report of his observations & if found positive then Search and Valuation reports are being prepared and submitted to us. The report should cover the present guideline value, market rate, forced sale value and accessibility to the site. The branch head/loan officer should also submit his independent valuation report. The least value should be treated as the value of the property.

For the Valuation of the property, legal documents like Sale Deed, Approved Plan from the local authority, Corporation tax receipt , Building Permit (covering letter of the sanctioned plan), should be obtained.

- 10.2. Legal Evaluation

A qualified lawyer will examine the property documents i.e. chain of agreements/title etc. to determine if the property documents provided are conducive for lending and provide us a search Report & latest tax paid receipt for the same. All the documents as per the legal opinion should be obtained. Legal opinion should be done with original set of documents. If legal opinion is obtained with copy documents, as and when original documents are obtained, the same should be sent to lawyer for his verification.

- 11. Loan Appraisal

The client visits our office with his requirements and personal details. He is then explained the complete procedure for availing the loan & all the necessary documents are called for. Applicable charges for sanctioning the loan should also be explained. As credit history plays an important part in the loan application process, it is always advisable to clarify and resolve any credit related issues before accepting the loan application. Past six months bank account statements and loan pass book copy (if any loan is availed earlier) should be obtained.

Our credit officer should ensure that reported income is acceptable and validate the accuracy of the information he/ she has provided. Credit check will then be carried out to reveal his/ her credit history. The maximum permissible amount should be arrived at, repayment capacity and the sources for the required margin money should be discussed in the appraisal note. It is always advisable to have a co borrower, if the requested loan is more than his repayment capacity. Then, a co borrower with sufficient income should be insisted. The co borrower should be explained in detail about the loan and why his signature is also obtained. In case if the third party collateral is obtained, (A third party security is security given by an individual which secures the liability of a third party) then it is advisable to include the property owner as co borrower instead of guarantor. In addition to this guarantee from spouse of the borrower, his son, brother or any other blood relation shall be insisted.

For sanctioning any loan for Commercial Purpose, ensure the following :-

Average DSCR – 1.50:1*

Leverage Ratio – 3 :1**

- 12. Loan Sanction& Sanction terms/conditions

12.1 Once the sanctioning authority is satisfied with the facts of the loan appraisal note he will accord his sanction for the requested loan with certain terms and conditions

12.2 For all Term Loans sanctioned under the Discretionary Power of Asst. Manager / Branch Head, Appraisal Note of such proposal should be forwarded to Head Office for approval.

12.3 Any limit over and above the Sanctioning power of Manager should be forwarded to the Managing Director through Head Office for sanction.

*DSCR: Debt Service Coverage Ratio is a measure of the cash flow available to pay current obligations.

DSCR = Net Operating Income / Total Debt Service

i.e., Profit after Tax Before Depreciation and Interest / Interest + instalment

**Leverage Ratio: The leverage ratio is the proportion of debts that a bank has compared to its equity/capital. Debt to Equity = Total debt / Equity.

12.4 We shall convey in writing to the borrower as understood by the borrower by means of sanction letter or otherwise, the amount of loan sanctioned along with the terms and conditions including annualized rate of interest and method of application thereof and keep the acceptance of these terms and conditions by the borrower on its record, as complaints received against NBFCs generally pertain to charging of high interest / penal charges. Hence we shall mention the penal charges charged for late repayment in the loan agreement. Borrowers may not be fully aware of the terms and conditions of the loans including rate of interest at the time of sanction of loans, either because we do not provide details of the same or the borrower has no time to look into detailed agreement. Not furnishing a copy of the loan agreement or enclosures quoted in the loan agreement is an unfair practice and this could lead to disputes and the borrower with regard to the terms and conditions on request of the borrower. On request, we shall furnish a copy of the loan agreement as understood by the borrower along with a copy each of all enclosures quoted in the loan agreement to all the borrowers at the time of sanction / disbursement of loans.

- 13. Disbursement of loans / changes in terms and conditions

We shall give notice to the borrower in the vernacular language or a language as understood by the borrower of any change in the terms and conditions including disbursement schedule, interest rates, service charges, prepayment charges etc. and shall also ensure that changes in interest rates and charges are effected only prospectively. Decision to recall / accelerate payment or performance under the agreement shall be in consonance with the loan agreement. We shall release all securities on repayment of all dues or on realisation of the outstanding amount of loan subject to any legitimate right or lien for any other claim they may have against borrower. If such right of set off is to be exercised, the borrower shall be given notice about the same with full particulars about the remaining claims and the conditions under which we are entitled to retain the securities till the relevant claim is settled/ paid.

- 14. Documentation

Loan agreement/s along with equitable mortgage documents are to be executed by the borrower/s & guarantor/s as required for loans. After sanction & completion of all the terms & conditions disbursement is to be done as per procedure laid down.

- 15. Mortgage

Mortgage is transfer of interest in any specific immovable property for the purpose of securing payment of money advanced or to be advanced by way of a loan, any existing or future debt, etc. The person who mortgages the property is called as “Mortgagor” and the person in whose favour property is being mortgaged is called the “Mortgagee” and the instrument by which mortgage is created is called the “Mortgage Deed“.

Wherever the loan is sanctioned on equitable mortgage of a property loan shall be released only after creating equitable mortgage.

An equitable mortgage on an immovable property can be created by a written deed. The deed would provide that the mortgagor has deposited the title – deeds of his property with the mortgagee – company in a notified town with intent to create a security thereon on the advance made.

An equitable mortgage in which the lender is secured by taking possession of all the original title documents of the property that serves as security for the mortgage. It gives the mortgagee the right to foreclose on the property, sell it, or appoint a receiver in case of nonpayment.

- 16. MODT:

For a loan where a property is mortgaged to our company, we should register the MODT. MODT refers to memorandum of deposit of title deeds, which is signed by the company and the customer at the time of deposit of title deed related to loan availed against property. A MODT has to be registered at Sub register office.

Details of property mortgaged property should be entered in the property document and the title deeds should be kept in safe custody. Along with the documents we should obtain the up to date Encumbrance certificate and tax paid receipt. EC and Tax receipt should be obtained every year and the same should be entered in a separate register.

On closure of the loan, branch head should ensure that the borrower is not having any direct or indirect liability to the company and forward the request to release the property document and cancel the MODT to higher authority for approval. On getting approval the property shall be released and MODT shall be cancelled. It is the responsibility of the company to cancel the MODT once the debts are cleared. Visit the sub register office with NOC and get the lien removed from the property.

- 17. CERSAI

Central Registry of Securitization Asset Reconstruction and Security Interest of India is a Government of India Company licensed under section 8 of the Companies Act, 2013 with Govt. of India having a shareholding of 51% by the Central Government and select Public Sector Banks and the National Housing Bank also being shareholders of the Company.

The object is to maintain and operate a Registration System for the purpose of registration of transactions of securitization, asset reconstruction of financial assets and creation of security interest over property, as contemplated under the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (SARFAESI Act). CERSAI is providing the platform for filing registrations of transactions of securitisation, asset reconstruction and security interest by the financial institutions.

At present the portal provides facility to file security interest in immovables created through all types of mortgages and in units under constructions besides filing of Security Interests in movables, intangibles and factoring transactions is also available on the portal. More than a statutory obligation CERSAI is a risk mitigation tool for the Finance companies and public at large to prevent multiple financing against the same property.

- GENERAL

18.1 Proposal processing charges

No processing charges for Jewel loans where gold jewels are taken as primary security. (For jewel loans, applicable appraiser fees shall be collected. ) For all other type of loans processing charge of 1% of the loan amount is to be collected from the borrower upfront.

18.2 Minimum Loan Interest

For all types of loan minimum interest to be collected from the borrower is Rs.50/- or actual interest whichever is higher.

18.3 Marking our interest in Govt.securities:

While sanctioning loan against Govt. securities, our interest should be marked before releasing the loan. (e.g. LIC policy – assignment, NSC – Lien ).

Our interest can be cancelled by Branch head after the closure of the loan in full and when there is no other direct or indirect liability to us.

18.4 Insurance on assets:

All the assets created out of our loan should be insured to the required value. The collateral security offered should also be insured. Our company name should be marked in the hypothecation clause. For the loans of Rs.50,000/- and less, Insurance shall be at the discretion of the borrower. If the loan amount is less than 1 lakh, the request for not insuring should be mentioned in the appraisal note and proper sanction should be obtained. An undertaking letter to be obtained stating that the insurance is not effected only on the request of the borrower and the borrower is responsible for the consequences, if any, in the event of loss.

18.5 Moratorium:

A moratorium period refers to a particular period of a loan tenure during which the borrower does not have to repay anything. It can be described as a waiting period before the borrower will have to start paying the equated monthly installments (EMIs) for his or her loan. Usually, when one applies for a loan, he or she will be required to pay the EMIs from day one until the last day of the loan tenure. However, when one has a moratorium period, he or she will not have to repay any amount to the lender. However, interest accrues during the moratorium period and the borrower must pay it.

The moratorium period meaning should be clear by now. This is usually given for project loans, education loans and home loans. This is also known as an EMI holiday at times. The main purpose of a moratorium period is to make sure that the loan applicant is financially ready to start repaying the loan. The purpose and requirement for moratorium should be discussed in the credit proposal and proper sanction should be obtained from the sanctioning authority for moratorium period.

18.6 Noting our hypothecation in RC book:

After disbursal of vehicle loans, hypothecation clause should be noted in the RC book. Duly signed two TO forms sets are to be obtained. Our interest can be cancelled by Branch head after the closure of the loan in full and when there is no other direct or indirect liability to us.

Branch should collect the Duplicate Key and copy of the RC Book, when vehicle loans are sanctioned and the same may be kept along with the loan documents.

18.7 Housing loans – release of loans in stages and age of the old house:

In case of housing loan for construction of new house, the loans should be released in stages.

For purchase of Flats under construction, payment should be released as per the Builder’s agreement.

For purchase of old house the residual life of the house should be not less than 15 years and repayment period should be 5 years less than the residual life of the house to be purchased.

Plan approval should be obtained wherever necessary.

For loans sanctioned for purchase of land and for construction of house, if the construction is not done within one year of purchase of land, interest at the rate of 21% should be charged from the loan beginning.

18.8 Monitoring aspects:

All standard assets should be monitored and followed up closely so as to retain them in the same status.

To ensure prompt repayment of loans branches should

- Explain clearly the terms of repayment to the borrower.

- The gestation period of the project should be assessed correctly at the stage of appraisal itself and instalment holiday should be got sanctioned.

- All accounts should be monitored as to the adherence of terms of repayment, operations etc.

- Instalment and interest due date should be intimated sufficiently earlier. During the initial days we use to follow up through telephonic reminder calls or by visiting the customer’s residence or business premises. We send written notices to the borrower informing them about the due EMI and requesting the borrower to clear the dues. Without giving any written notice, the company does not initiate any legal or any other recovery measure including the repossession of the security. If the borrower is intentionally avoiding calls, then we are free to move ahead with the repossession in case of secured loans and legal proceeding of recoveries in case of Unsecured loans.

- All mortgaged properties should be verified every year and all hypothecated properties should be verified every quarter and recorded in a separate Register.

18.9. Penalty Charges:

If the periodical installment and or interest is not paid on the due date, the penal charges @ 2% over and above the applicable rate will be charged on the entire balance outstanding in the loan account from the date of irregularity up to the date of regularization.

18.10. Documentation charges:

* Rs.500/- plus tax for each loan.

18.11.Inspection charges:

* Rs.500/- plus tax, if the property to be mortgaged is located within the branch limit and Rs.500/- plus tax plus actual travelling expenses.

18.12. * Minimum interest for term loan is one month interest on loan amount.

* CIBIL report to be obtained before sanctioning of the term loan and necessary charges should be collected.

* For second hand machinery and vehicles, value’s certificate is compulsory.

- Rescheduled loan:

When the lender extends the repayment period, it amounts to rescheduling the loan.

Rescheduled loans are most common when the borrower informs the lender that he/she will be unable to repay the loan in time, or when the borrower cannot afford

payments.

Because a default would hurt both the borrower and the lender, the lender often works with the borrower through options, such as rescheduling the repayment.

New loan replaces the outstanding balance of an older loan, as is paid over a longer period, usually with a lower installment amount. Loans are commonly rescheduled to accommodate a borrower in financial difficulty and thus, to avoid a default. It is also called Restructured Loan.

19.1. Reschedule Ent within the original time frame will be considered, on the following conditions:

- I)Interest should not be in default.

- II)If current interest rate is higher than document rate, then deferred installments would carry the current rate of interest and would be adjusted at the end.

- III) If current interest rate is lower, then document rate would be charged.

19.2. Where the repayment span extends beyond the original time frame

- I)Interest default of up to four quarters shall be the thresh hold limit for identification of proposal for reschedulement beyond the original time frame. Interest overdue should be cleared before consideration of reschedulement request.

- II)Wherever the current rate is higher than document rate, the deferred installments or the amount shifted beyond the original repayment span, whichever is higher, would carry current rate of interest and would be adjusted at the end.

- III) Wherever the document rate is higher than the current rate, all the installments would carry interest at document rate.

- IV)Normally not more than two reschedulement would be considered. Wherever second reschedulement is to be considered, the deferred installments for bearing higher rate of interest as per above proposal would relate to the original repayment schedule.

- V)Loans would not be rescheduled by more than 4 years beyond the terminal date of the original repayment schedule.

- We may restructure the accounts classified under ‘standard’, ‘substandard’ and ‘doubtful’ categories.

- We cannot reschedule / restructure / renegotiate borrowal accounts with retrospective effect. While a restructuring proposal is under consideration, the usual asset classification norms shall continue to apply.

- Normally, restructuring cannot take place unless alteration / changes in the original loan agreement are made with the formal consent / application of the debtor. However, the process of restructuring can be initiated by the company in deserving cases is subject to customer agreeing to the terms and conditions.

- No account shall be taken up for restructuring by the company unless the financial viability is established and there is a reasonable certainty of repayment from the borrower, as per the terms of restructuring package. Any restructuring done without looking into cash flows of the borrower and assessing the viability of the projects / activity financed by the company shall be treated as an attempt at ever greening a weak credit facility

- Borrowers indulging in frauds and malfeasance shall continue to remain ineligible for restructuring.

19.3. Asset classification norms for Rescheduled loan:

The accounts classified as ‘standard assets’ shall be immediately reclassified as ‘sub-standard assets’ upon restructuring.

The non-performing assets, upon restructuring, shall continue to have the same asset classification as prior to restructuring and slip into further lower asset classification categories as per extant asset classification norms with reference to the pre-restructuring repayment schedule.

Standard accounts classified as NPA and NPA accounts retained in the same category on restructuring by the company shall be upgraded only when all the outstanding loan / facilities in the account perform satisfactorily during the ‘specified period’ i.e. principal and interest on all facilities in the account are serviced as per terms of payment during that period.

In case, however, satisfactory performance after the specified period is not evidenced, the asset classification of the restructured account shall be governed as per the applicable prudential norms with reference to the pre-restructuring payment schedule.

19.4 Interest income in respect of restructured accounts

classified as ‘standard assets’ shall be recognized on accrual basis and that in respect of the accounts classified as ‘non-performing assets’ shall be recognized on cash basis.

19.5 Provision on restructured advances

The company shall hold provision against the restructured advances as per the extant provisioning norms.

Restructured accounts classified as standard advances shall attract a higher provision in the first two years from the date of restructuring. In cases of moratorium on payment of interest / principal after restructuring, such advances shall attract the prescribed higher provision for the period covering moratorium and two years thereafter.

Restructured accounts classified as non-performing advances, when upgraded to standard category shall attract a higher provision in the first year from the date of upgradation.

- 20. Loans against security of gold jewellery

20.1. Safety and security

When we are lending against collateral of gold jewelry, we shall ensure that necessary infrastructure and facilities are put in place, including safe deposit vault and appropriate security measures for operating the vault, in each of its branches where gold jewellery is accepted as collateral. This is required to safeguard the gold jewellery accepted as collateral and to ensure convenience of borrowers.

No new branch/es shall be opened without suitable arrangements for security and for storage of gold jewellery, including safe deposit vault. Besides, no new branches shall be allowed to be opened without the facilities for storage of gold jewellery and minimum security facilities for the pledged gold jewellery. Appropriate insurance for the jewels in the vault should be made without fail.

20.2. Loan to value ratio (LTV)

While sanctioning loan against the security of gold jewellery it is mandatory to maintain a Loan-to-Value (LTV) Ratio not exceeding 75 per cent for loans. Provided that the value of gold jewellery for the purpose of determining the maximum permissible loan amount shall be the intrinsic value of the gold content therein and no other cost elements shall be added thereto.

Standardization of Value of Gold accepted as collateral, while arriving at LTV Ratio the gold jewellery accepted as collateral shall be valued by taking into account the preceding 30 days’ average of the closing price of 22 carat gold as per the rate quoted by the Indian Bullion and Jewelers Association Ltd. (IBJA) or the historical spot gold price data publicly disseminated by a commodity exchange regulated by the Forward Markets Commission.

20.3. Restrictions

We shall not grant any advance against bullion / primary gold and gold coins. And shall not grant any advance for purchase of gold in any form including primary gold, gold bullion, gold jewellery, gold coins, units of Exchange Traded Funds (ETF) and units of gold mutual fund.

20.4. Verification of the Ownership of Gold

Where the gold jewellery pledged by a borrower at any one time or cumulatively on loan outstanding is more than 20 grams, we shall keep a record of the verification of the ownership of the jewellery. The ownership verification need not necessarily be through original receipts for the jewellery pledged but a suitable document shall be prepared to explain how the ownership of the jewellery has been determined, particularly in each and every case where the gold jewellery pledged by a borrower at any one time or cumulatively on loan outstanding is more than 20 grams.

20.5. Auctioning of overdue jewel loan jewels

Auctioning of overdue jewel loan jewels

Board approved policies on auction of gold jewellery that are transparent to the borrower and adequate prior notice has to be issued to her/him.

As per the RBI guidelines, the company or its promoters cannot participate actively in Jewel Loan auction and a qualified and experienced auctioneer will be appointed by the company to carry out the auction on behalf of the company. As such Mr. M.Narayanan, S/o Sri Late P.R.MuthiahChettiar residing at 13, Sivagangai Road, Sathamangalam, Madurai – 20 is identified as a suitable person to act as Jewel Auctioneer. As per the proceedings of the District Revenue Officer, Madurai, Mr. Narayanan is the Approved Auctioneer for Madurai Revenue Division for the entire Madurai District as per Rule 12(2) of the Tamilnadu Pawn Broker Rules, 1944, vide proceedings dated 22.06.1992. He has also been approved as Auctioneer for Virudhunagar District, vide Proceedings of District Revenue Officer and Additional District Magistrate, Virudhunagar District, vide proceedings dated 11.02.2005. He is conducting the sale of the barred unclaimed pledged articles in a satisfactory manner in various institutions.

Auction should be conducted in the same town or taluk in which the branch that has extended the loan is located.

While auctioning we should declare a reserve price for the pledged ornaments. The reserve price for the pledged ornaments should not be less than 85% of the previous 30 day average closing price of 22 carat gold as declared by The India Bullion and Jewellers Association Ltd. (IBJA) and value of the jewellery of lower purity in terms of carats should be proportionately reduced.

It is mandatory to provide full details of the value fetched in the auction and the outstanding dues adjusted and any amount over and above the loan outstanding should be payable to the borrower.

We must disclose in our annual reports the details of the auctions conducted during the financial year including the number of loan accounts, outstanding amounts, value fetched and whether any of its sister concerns participated in the auction.

20.6. Jewel Loan card

As a token of having pledged the jewels, issue a card to the borrower, which should contain the following particulars

Name, account number, loan date, loan amount, details of jewels and due date of the loan. Borrower should be instructed to bring the card, while remitting the part amount/interest. At the time of closing, the card should be surrendered by the borrower for taking back the jewels. If the borrower has lost his card, he/she should submit an indemnity in a white sheet for having lost the card and the same should be duly witnessed and a duplicate card shall be issued based on the indemnity and marked as DUPLICATE. For issuing the duplicate card a nominal amount of Rs.20/- + applicable tax should be collected. Branch Manager can waive the duplicate card charge at his discretion. Details of duplicate cards issued and charges details shall be noted in a separate register and the same shall be reported in the monthly review report. In no case a jewel loan should be closed without the card.

20.7. Release of Jewel loan jewels to third party

Normally the jewel loan jewels are returned to the person who has pledged the jewels. Sometimes the borrower who has pledged the jewel could not come in person for various reasons of his own. In such times the jewels shall be released to the third party on completing the following formalities.

- An authorization letter from borrower stating the acceptable reason why he/she is unable to come in person,

- To whom he is authorizing to get back the jewels on his behalf.

- Signature of the authorized person should be attested by the borrower.

- Identity proof of the person to whom the jewels are to be released.

- At the time of release, the signature of the authorized person should be obtained over Re1/- revenue stamp.

20.8. Appraisal of jewel loan jewels

All jewel loan jewels should be appraised for its purity. The appraisal shall be done by the appointed jewel appraiser and if the branch Manager is having the knowledge of appraising the jewels, he also can do the job in due diligence in the absence of appointed jewel appraiser. Once the jewel appraiser joins duty he should appraise the same and confirm the correctness. The applicable fees should be collected without fail.